reverse tax calculator formula

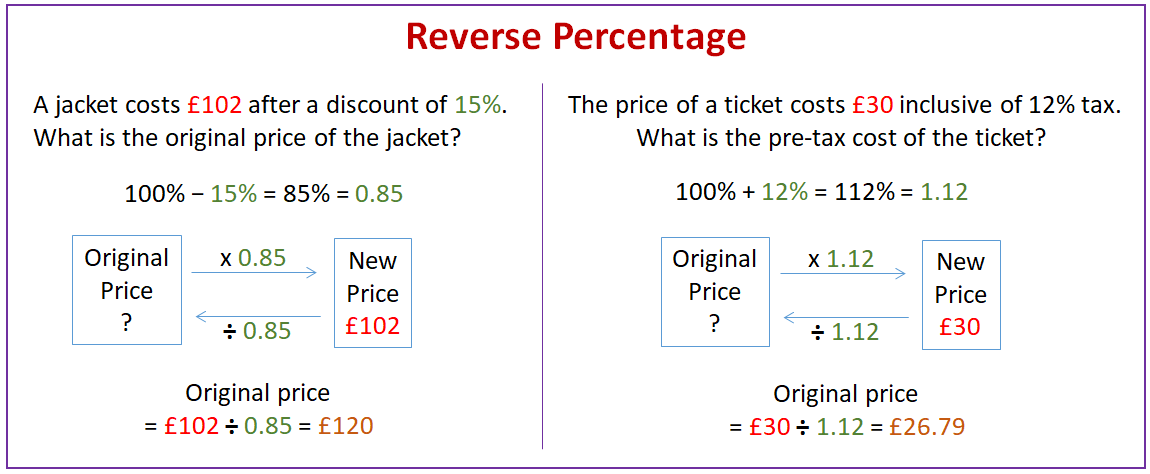

To make things simple you can also depend on the reverse percentage calculator. Divide the final amount by the decimal to find the original amount before the percentage was added.

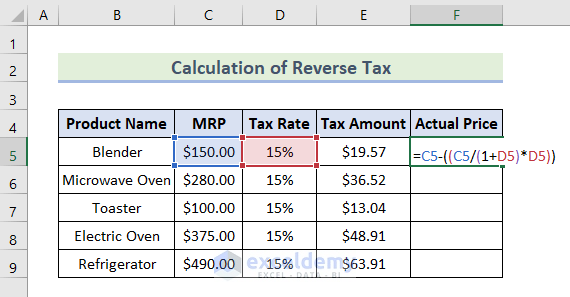

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Tax Amount Original Cost - Original Cost 100100 GST or HST or PST Amount.

. Tax Year - Select the Tax Year to calculate tax years start 6th April and end 5th April. 1 006 106 1006 106. However in those cases where a price inclusive is mentioned a reverse GST calculator will need to be applied.

Like above this also. Net Sale Amount. Amount with sales tax 1 HST rate100 Amount without sales tax.

Instead of using a sales-tax calculator you use whats jokingly called a sales tax decalculator The formula is fairly simple. Amount with taxes Canada Province HSTQSTPST variable rates Amount. Reverse Sales Tax Formula.

X 100 Y result. Therefore a 750000 prepayment 75 of 1000000 is due on January 20 2016After month end the business determines that January 2016s actual total tax liability. Pre-tax price Final price 1 Sales tax rate For example if the final price of an item is 25.

PRETAX PRICE POSTTAX PRICE 1 TAX RATE. The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax. 1 0.

Amount without sales tax x HST rate100 Amount of HST in. The invoice bill to the customer will be 105000 100000 5000 and it is known as the total sale include tax. In this example work.

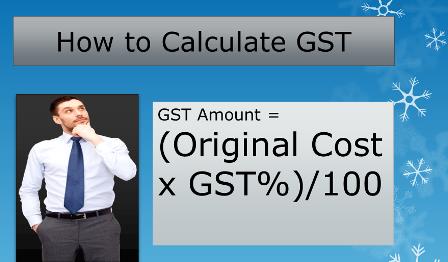

0 6 1. The reverse sale tax will be calculated as following. How do you calculate reverse GST.

You can calculate the reverse tax by dividing your tax receipt by 1 plus. This is the NET amount after Tax the. Notice my main language is not English.

Do you like Calcul Conversion. Here is how the total is calculated before sales tax. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a.

Formula s to Calculate Reverse Sales Tax. After 1996 several provinces adopted HST a combination of PST and GST into a single value-added tax. Formula for reverse calculating HST in Ontario.

Tax reverse calculation formula. The GST rate was decreased from 7 to 5 between 2006 to 2008. I appreciate it if.

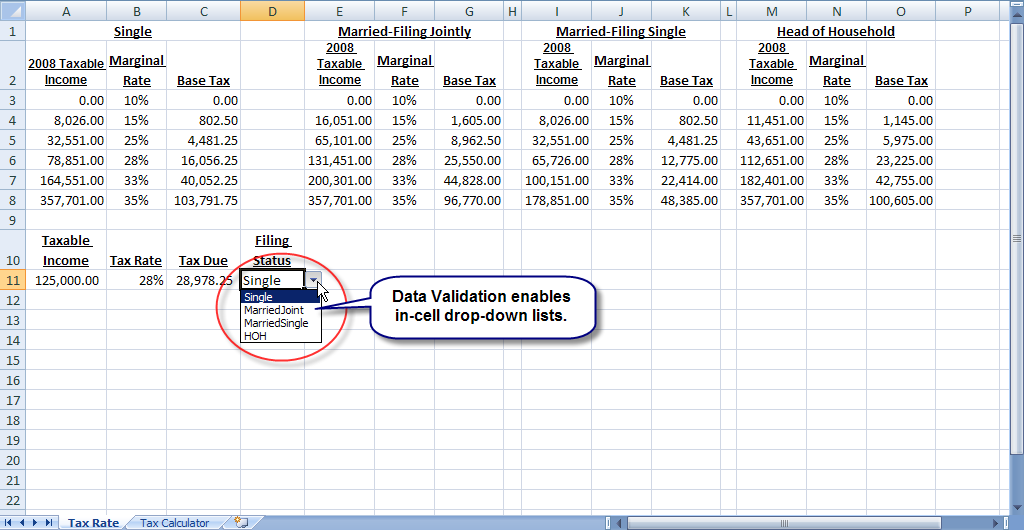

Reverse Sales Tax Calculations. 06 r6 100sum p5q5 p6 o6p5. Divide your sales receipts by 1 plus the sales tax.

Reverse tax calculation based on 20 100 100120 or 100120. Calculate the canada reverse sales taxes HST GST and PST. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Net Income - Please enter the amount of Take Home Pay you require. Reverse tax calculation based on 17 100 100117 or 100117 8547 171452. If you know the final price and the sales tax rate the formula for calculating the pre-tax price is.

Calculates the canada reverse sales taxes HST GST and PST.

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Excel Tutorial Formulas For Calculating Gst At 15 Youtube

Reverse Sales Tax Calculator 100 Free Calculators Io

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Reverse Percentage Examples Solutions Videos Worksheets Activities

Best Excel Tutorial How To Calculate Gst

Taxable Income Formula Examples How To Calculate Taxable Income

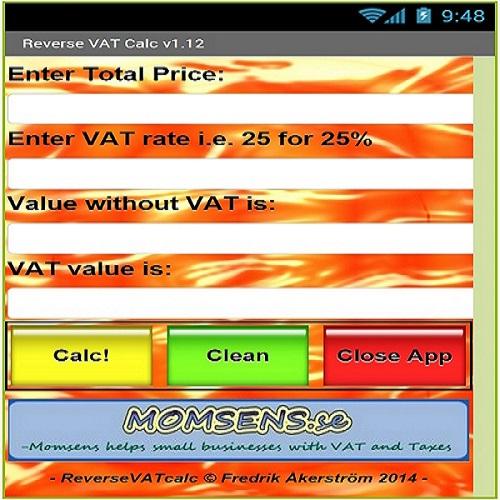

Backward Vat Calculator Accounting Finance Blog

Pre Tax Income Ebt Formula And Calculator

Reverse Calculation Of Tax Using Calculation Type H Sap Blogs

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Calculate Lifo And Fifo Zenledger

V A T Calculator Pro Tax Me By Tardent Apps Inc

Texas Sales Tax Calculator Reverse Sales Dremployee

Gst Calculator Online Formula With Example Excel Sheet

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Easiest Fica Tax Calculator For 2022 2023

How Does Reverse Sales Tax Calculator Puerto Rico Work 360 Taxes